Was the boost in digital payments after demonetization temporary?

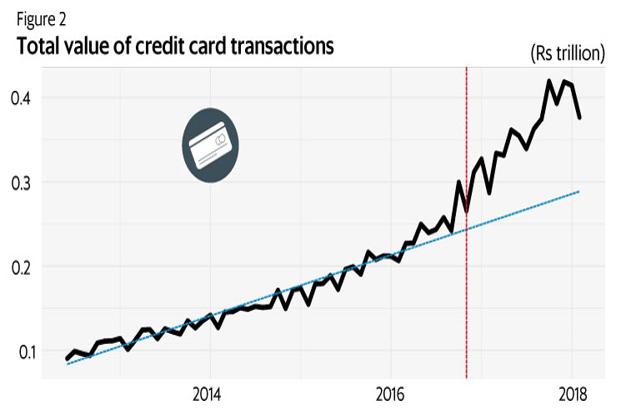

Credit cards, on the other hand, weren’t affected as much by demonetization, possibly because users of credit cards were already clued in to the digital payments network.

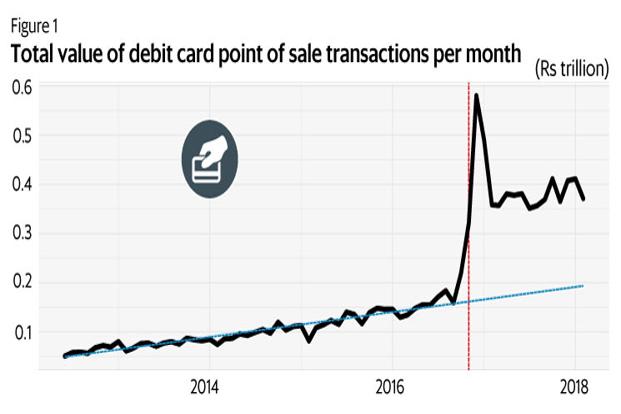

One of the stated aims of the demonetization exercise of November 2016 was to give a boost to digital payments. While digital payments soared in the wake of demonetization (since people had to find quick substitutes for cash), critics were quick to point out that it was a temporary effect, and the payments would be back to their pre-demonetization levels once there was sufficient currency in circulation again.

With the benefit of hindsight, and Reserve Bank of India (RBI) data, we can say that demonetization did have a large positive impact on digital payments. In fact, based on one metric, the volume of digital payments in India has doubled thanks to demonetization. This metric is the total value of transactions made using debit cards at point of sale (PoS) machines.

The growth rate of debit card usage at PoS has fallen compared to pre-demonetization times. Link to the article

After the post-demonetization spike, usage of debit cards at PoS terminals reached a steady state sometime around March-April 2017. And if we look at the blue dotted line, which shows the trend at which digital payments would have grown in the absence of demonetization, we see that the actual data point for January 2018 (around Rs40,000 crore) is about twice the value suggested by the trend line.

There is no spike associated with demonetization when it comes to credit card usage, though the rate of growth of usage has increased sharply after demonetization.We might conclude from this that while demonetization may not have incentivized people to start using credit cards, it surely did get people to use their credit cards more.